The City of Jamestown received a clean report in its annual audit. This was the first audit of the city done by Drescher and Malecki. Partner Carl Widmer complimented the city, saying the process was an easy transition. He said after the pandemic, the city had just over $1 million dollars in revenues.

The City of Jamestown received a clean report in its annual audit. This was the first audit of the city done by Drescher and Malecki. Partner Carl Widmer complimented the city, saying the process was an easy transition. He said after the pandemic, the city had just over $1 million dollars in revenues.

Widmer said one entity that municipalities look to for best practices and guidance is the GFOA, or Government Finance Officers Association, “A recommended minimum level of unassigned fund balance is two months of 16.7%. So looking at the city’s, you’re currently at 12.4%, but as you see that 12.4% has grown from 2% just five years ago. So you’re on the right path. The fund balance is improving.”

Widmer said the management letter made some recommendations including implementing a fund balance policy, “And that would really help identify what the city believes to be an appropriate amount of that unassigned fund balance in the general funds. So currently that $4.6 million is a little over 12%. What is the level the city is comfortable maintaining? Because, it relates to the city’s ability to respond to emergencies in the event that something unbudgeted occurs.”

Another recommendation included updating payroll software to improve efficiencies and give Finance more tools for reports.

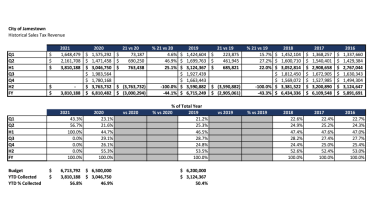

Sales tax receipts were up almost 47% for the second quarter compared to 2020 for the City of Jamestown. City Comptroller Ryan Thompson reported to City Council that the City received $2-million-161-thousand dollars for the 2021 second quarter payment. That’s $690-thousand-250 dollars more than in 2020 and a 27% increase from 2019’s second quarter receipts.

Sales tax receipts were up almost 47% for the second quarter compared to 2020 for the City of Jamestown. City Comptroller Ryan Thompson reported to City Council that the City received $2-million-161-thousand dollars for the 2021 second quarter payment. That’s $690-thousand-250 dollars more than in 2020 and a 27% increase from 2019’s second quarter receipts.

Thompson said this is great news, “I think a lot of things, obviously the online sales tax collections are driving that as well as the price of gas is up significantly over the last couple years.”

Thompson said the city’s 2021 adopted sales tax budget is $6-million-713-thousand-792-dollars. He said the city has already collected 56.8% of the budget after the second quarter, which compares to 46.9% at the same time last year. Sales tax receipts for 2021 second quarter are up significantly to previous years going back to 2016.

Jamestown City Council reviewed a $36-thousand-680-dollar grant from FEMA for fire prevention and safety training. Public Safety Committee Chair Brent Sheldon said the grant will allow children from around the county to be educated on fire safety and that free smoke alarms will be provided to children as well.

Mayor Eddie Sundquist thanked Deputy Fire Chief Matt Coon and Fire Prevention Officer Rob Smith for their work with the Chautauqua County Safety Village, “And applying for that FEMA grant, it’s a really big thing. They’ve been trying to be much more active in the community, they’re already pretty active, but to be able to go out and use the media and to partner with the Safety Village in doing that great work is a really huge thing. So I just want to thank the Deputy Fire Chief and his staff.”

The grant allows for an ad campaign in conjunction with the Safety Village to promote the classes, fire prevention and safety more broadly.

Leave a Reply